Nvidia Q2 2025 Earnings Reports: In a much-anticipated report, Nvidia released its earnings for Q2 2025 after the market close, reinforcing its dominance in the semiconductor industry. With the company at the heart of the AI revolution, expectations were high, and Nvidia did not disappoint. Here’s a closer look at the highlights and what they mean for investors and the broader tech landscape.

Record Revenue Driven by AI Demand

Nvidia’s earnings report for the second quarter of fiscal 2025 showcased record-breaking revenue, propelled by the surging demand for AI and data center products. The company reported revenue of $16 billion, exceeding Wall Street’s already high expectations. This represents a year-over-year increase of over 100%, underscoring Nvidia’s pivotal role in the AI boom.

The explosive growth was primarily driven by Nvidia’s data center business, which includes GPUs that power AI applications. The demand for these GPUs has been fueled by the ongoing adoption of AI technologies across various industries, from healthcare to automotive. As companies continue to integrate AI into their operations, Nvidia’s products have become essential for processing and analyzing large datasets, driving massive growth in this segment.

Data Center Dominance

Nvidia’s data center segment emerged as the star of the earnings report, contributing $10 billion to the company’s total revenue. This marks a significant increase from the $3.8 billion reported in the same quarter last year. The company’s GPUs are now the backbone of many AI models, including generative AI, which has seen widespread adoption in recent years.

The company’s leadership in this space can be attributed to its robust portfolio of AI hardware and software solutions. Nvidia’s A100 and H100 GPUs are now the go-to choices for companies building AI infrastructures, enabling faster and more efficient processing of complex algorithms. Moreover, Nvidia’s software ecosystem, including its CUDA platform, has become indispensable for developers working on AI projects, further entrenching the company’s position in the market.

Gaming Segment Sees Resilience

While the data center segment stole the spotlight, Nvidia’s gaming division also showed resilience in Q2 2025. The company reported gaming revenue of $3.5 billion, up from $2.9 billion in the previous quarter. This growth was driven by the continued strong demand for Nvidia’s GeForce RTX graphics cards, which are popular among gamers and content creators alike.

Despite concerns about a potential slowdown in the gaming industry, Nvidia’s results indicate that the company’s gaming products remain in high demand. The GeForce RTX series has been particularly successful, thanks to its advanced ray-tracing capabilities and support for AI-enhanced graphics, which deliver a superior gaming experience. Additionally, Nvidia’s focus on the growing esports market and its partnerships with major game developers have helped maintain its dominance in the gaming sector.

Automotive and Professional Visualization: Emerging Growth Areas

Nvidia’s automotive and professional visualization segments also contributed to the company’s impressive performance. The automotive division reported revenue of $500 million, a 60% increase from the same quarter last year. This growth was driven by the rising adoption of Nvidia’s AI-powered solutions in autonomous vehicles and advanced driver assistance systems (ADAS).

The professional visualization segment, which includes Nvidia’s Quadro GPUs used in industries such as architecture, engineering, and media, generated $700 million in revenue. This represents a 40% year-over-year increase, highlighting the expanding use of Nvidia’s technologies in professional applications.

Both segments are emerging as key growth areas for Nvidia as the company continues to diversify its revenue streams. The automotive sector, in particular, holds significant potential as the shift towards electric and autonomous vehicles accelerates. Nvidia’s DRIVE platform, which provides the hardware and software needed for autonomous driving, is gaining traction among automakers, positioning the company for long-term growth in this market.

Gross Margins and Profitability

Nvidia’s gross margins also saw a substantial increase, rising to 68% from 55% in the same quarter last year. This improvement reflects the higher ASPs (Average Selling Prices) of Nvidia’s data center products, as well as the company’s ability to manage costs effectively. The strong gross margin performance translated into robust profitability, with Nvidia reporting a net income of $6 billion, up from $2.3 billion in Q2 2024.

The company’s profitability was further bolstered by its efficient supply chain management and strategic investments in AI research and development. Nvidia’s focus on innovation and its ability to bring cutting-edge products to market quickly have allowed it to capitalize on the growing demand for AI solutions.

Stock Performance and Market Reaction

Following the release of the earnings report, Nvidia’s stock saw a significant after-hours surge, reflecting investor confidence in the company’s future prospects. The stock has already been one of the best performers in the market this year, and the latest earnings report is likely to fuel further gains.

Nvidia’s strong performance has also had a ripple effect on the broader semiconductor industry, with other chipmakers seeing a boost in their stock prices. The company’s results underscore the importance of AI in driving the next wave of growth for the tech sector, and Nvidia is well-positioned to lead this transformation.

Future Outlook and Guidance

Looking ahead, Nvidia provided an optimistic outlook for the remainder of fiscal 2025. The company expects continued strong demand for its data center products as AI adoption accelerates across various industries. Nvidia also anticipates growth in its gaming and automotive segments, supported by new product launches and expanding market opportunities.

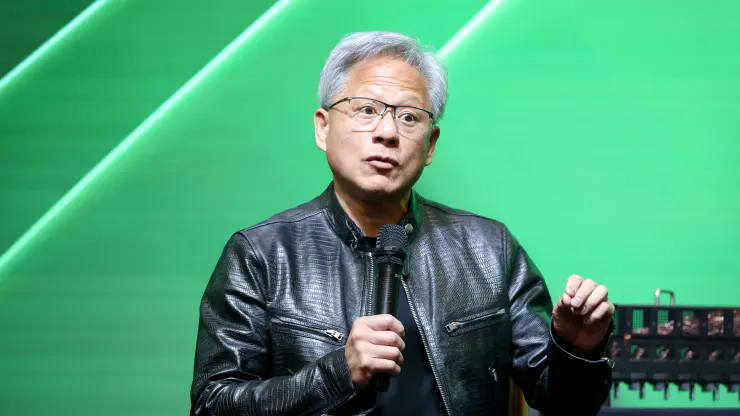

Nvidia’s CEO, Jensen Huang, emphasized the company’s commitment to innovation and its focus on developing next-generation AI technologies. He highlighted Nvidia’s plans to expand its AI software and hardware offerings, as well as its efforts to build partnerships with key players in the tech industry. These initiatives are expected to drive sustained growth and solidify Nvidia’s leadership position in the AI space.

Challenges and Risks

Despite the strong performance, Nvidia faces several challenges that could impact its future growth. The ongoing global semiconductor shortage remains a concern, as it could disrupt Nvidia’s supply chain and limit its ability to meet the growing demand for its products. Additionally, increased competition from other chipmakers, such as AMD and Intel, could pressure Nvidia’s market share in key segments.

Regulatory scrutiny is another potential risk, particularly as Nvidia continues to expand its presence in the AI and data center markets. The company’s proposed acquisition of Arm Holdings, a major player in the semiconductor industry, has faced regulatory hurdles, and any delays or complications in this deal could affect Nvidia’s growth strategy.

Moreover, geopolitical tensions and trade restrictions could also pose challenges for Nvidia, especially in key markets such as China. The company’s ability to navigate these risks will be crucial in sustaining its growth trajectory in the coming years.

Nvidia’s Q2 2025 earnings report highlights the company’s strong performance across its key business segments, driven by the accelerating adoption of AI technologies. With record revenue, robust profitability, and a positive outlook for the future, Nvidia continues to solidify its position as a leader in the semiconductor industry. However, the company must navigate several challenges to maintain its growth momentum.

For more insights on the latest trends in the tech industry, visit Digital Digest and stay informed on the developments that matter most.